Corporate Governance Framework

- Election and Term of Office of Directors

-

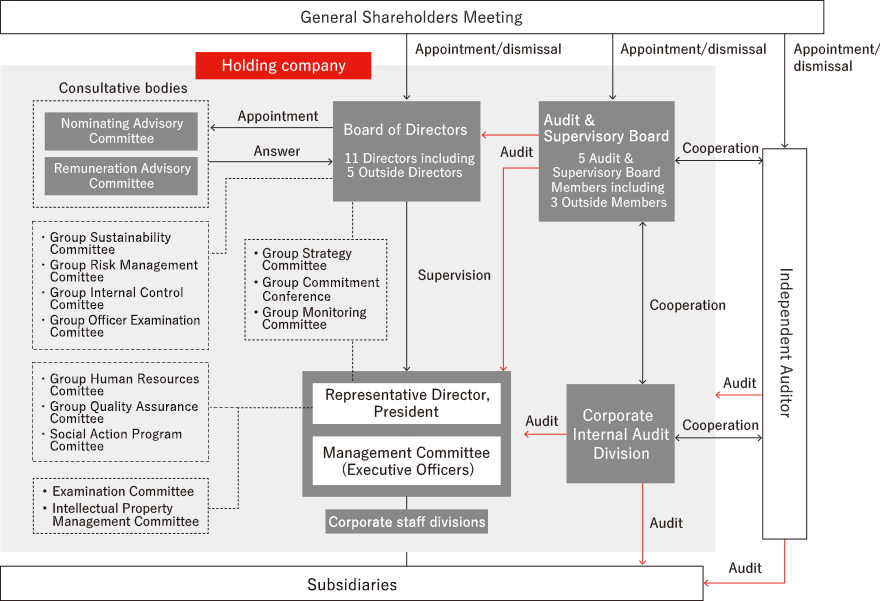

The Board of Directors comprises up to 11 members, appointed to one-year terms in order to enhance flexibility in response to changes in business conditions. Resolutions to appoint directors must be approved by a majority of shareholders, with at least one third of those shareholders who have voting rights in attendance. To improve transparency and strengthen supervisory functions, five of the current 11 directors are outside directors. The Board meets at least once a month.

- Roles and Responsibilities of the Audit & Supervisory Board and Members

-

Nichirei has adopted the Audit & Supervisory Board Member system. Of the five Audit & Supervisory Board Members , three are outside Audit & Supervisory Board Members , of whom one has experience at a financial institution, another is an experienced attorney, and the third has worked at a government agency.

The Audit & Supervisory Board meets once a month, in principle, convening additional meetings as necessary. Nichirei has established a framework to enhance the supervisory functions of Audit & Supervisory Board Members, allowing for the effective use of Audit & Supervisory Board Members, and strengthening the supervisory role of management.

- Independent Outside Directors and Outside Audit & Supervisory Board Members

-

A vested interest in Nichirei is denied outside directors and their close relatives, as well as outside Audit & Supervisory Board Members and any companies or organizations of which they are directors or that they serve in other important positions.

- Internal Audits, Audits by Audit & Supervisory Board Members, and Accounting Audits

-

Audit & Supervisory Board Members at the holding company and four core operating companies hold regular liaison conferences, conduct joint audits, and ensure the effective auditing of Group-wide management. The Corporate Internal Audit, responsible for internal auditing, conducts business execution and accounting accounts to verify the status of internal controls across management activities, and offers advice as necessary, in order to ensure strict compliance and observance of the Group code of conduct, and raise awareness of risk management. In addition, the division conducts facility audits—inspecting the status of production plants, distribution centers, and other facilities—providing appropriate guidance and advice.

The Company‘s accounting is audited by Ernst & Young ShinNihon LLC. The rotation of the managing partners is appropriately implemented. They have not involved in the audit for more than seven consecutive accounting periods. The lead engagement partner has not been involved in the audit for more than five consecutive accounting periods. The managing partners will have an interval of five accounting periods after being replaced. The lead engagement partner will not be involved in the company again.

- Committees for Effective Corporate Governance

-

Nichirei has set up committees to advise the Board of Directors, to ensure effective corporate governance. The committees include the Nominating Advisory, Remuneraiton Advisory,Sustainability,Risk Management,Internal Control,Officer Examination. Group Risk Management, Group Internal Control, Group Officer Examination.

In addition, to advance the execution of business by the president, we have set up the Group Human Resources,Group Quality Assurance,Social Action Program,Management,Examination, and Intellectual Property Management Committees, an overview of which follows.Nominating Advisory Committee Convened by the chairperson twice yearly and as required Remuneration Advisory Committee Convened by the chairperson twice yearly and as required Group Sustainability Committee Convened by the chairperson third yearly and as required Group Human Resources Committee Convened by the chairperson twice yearly and as required Group Risk Management Committee Convened by the chairperson twice yearly and as required Group Quality Assurance Committee Convened by the chairperson twice yearly and as required Group Internal Control Committee Convened by the chairperson once yearly and as required Group Officer Examination Committee Convened by the chairperson as required Social Action Program Committee Convened by the chairperson once yearly and as required Management Committee Held weekly on Tuesdays, except the third Tuesday of the month Examination Committee Convened by the chairperson as required Intellectual Property Management Committee Convened by the chairperson as required

- Director Compensation

-

Policy for determining directors (and other officers) remuneration

(i)Basic policy

Directors (excluding outside directors) - Remuneration shall strongly encourage directors to perform their duties in accordance with the Group’s management principles, “Sustainability Policy - The Nichirei Pledge” and management strategy

- In order to achieve the long-term management goal, remuneration shall strongly motivate directors to achieve specific management goals with regard to the Group’s material matters (materiality) and its medium-term business plan.

- In order for remuneration to function as a proper incentive toward the sustainable growth of the Group, the ratio of remuneration linked to short-term results and performance of duties (performance-linked bonuses) and remuneration linked to medium- to long-term results and corporate value (stock compensation) shall be set in an appropriate manner.

- Remuneration shall be adequate treatment for the positions as directors and executive officers of the Company in consideration of the significance of the Group’s social roles and responsibilities, trends at companies competing with the Group in business and human resources, including those in the food and logistics industries, and changes in the business environment.

Outside directors - In light of their role to supervise the Company’s management from an independent and objective standpoint, remuneration shall be only base remuneration (fixed remuneration).

(ⅱ)Composition and levels of remuneration

■Directors (excluding outside directors)

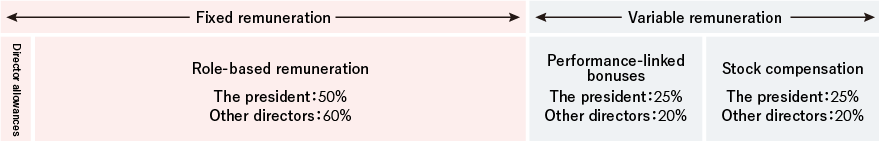

Remuneration for directors, excluding outside directors, shall consist of “Role-based remuneration” and “Director allowances” as base remuneration (fixed remuneration) and “Performance-linked bonuses” and “Stock compensation” as variable remuneration, as shown in the table below. The ratio of “Role-based remuneration,” “Performance-linked bonuses,” and “Stock compensation” related to the execution of duties shall be set so that the standard amount would be 50%:25%:25% for the president, while for other directors, the ratio shall be 60%:20%:20%. Remuneration levels shall be set at appropriate amounts with reference to objective remuneration market survey data (remuneration levels of companies competing with our Group in business and human resources, including those in the food and logistics industries), taking into consideration the responsibilities and number of our directors and future changes in the business environment, and incorporating the opinions of third-party organizations.

Components of composition of remuneration Composition ratio Purpose/Description Base Remuneration

(Fixed Remuneration)Role-based remuneration President: 50%

Other directors: 60%Basic remuneration for the execution of duties (performance of duties)

Set according to the significance of the role of each directorDirector

allowancesFixed amount Remuneration for the responsibilities of making management decisions and supervising the execution of the management decisions

Set at a uniform amount for all directorsVariable Remuneration Performance-linked bonuses President: 25%

Other directors: 20%Remuneration for motivating directors to achieve annual financial and strategic goals The amount paid upon achievement of goals (“standard amount”) is set as a percentage of role-based remuneration

Paid within a range of 0% to 200% of the standard amount according to the degree of achievementStock compensation

(Restricted shares)President: 25%

Other directors: 20%Remuneration for encouraging management from a long-term/Group-wide perspective and the perspective of shareholders and investors

Value of shares delivered each fiscal year (“standard amount”) is set as a percentage of role-based remuneration

Restricted shares are delivered every year in an amount equal to the standard amount, and restrictions are lifted upon directors’ retirement■Outside directors

Outside directors shall be paid only a base remuneration (fixed remuneration). Base remuneration consists of “Basic remuneration,” which is paid in a uniform amount to all outside directors as members of the Board of Directors, and “Chairperson’s allowance,” which is additionally paid to the chairperson of either the Nominating Advisory Committee or the Compensation Advisory Committee. The level of remuneration shall be set at an appropriate amount, taking into consideration the time and effort spent by each outside director to fulfill their expected roles and functions, as well as objective remuneration market survey data (remuneration levels of companies similar in size to ours (all industries).

- Board of Directors Evaluations

-

The Board of Directors of the Company analyzes and evaluates its own performance with the aim of ensuring its effectiveness, with the assistance of outside experts as necessary, and accordingly discloses summaries of such findings. The findings in FY2025 are described below.

1.Evaluation

procedure- SubjectsDirectors and Audit & Supervisory Board Members (16 individuals in total)

- PeriodFrom January 2025 to February 2025

- MethodSelf-assessment involving a questionnaire survey conducted by a third party

- (1)Questionnnaire survey

- Rating on a scale of one five, combined with open responses in 10 categories(42 questions)

- [categories]

- i. Roles and functions / scale and structure of the Board of Directors

- ii. Management conditions of the Board of Directors

- iii. Structure and roles / management conditions of the Nominating Advisory Committee

- iv. Structure and roles / management conditions of the Remuneration Advisory Committee

- v. Roles of and support system for outside directors

- vi. Roles of and expectations for Audit & Supervisory Board members

- vii. Relationship with investors and shareholders, etc.

- viii. Governance structure of the Company and overall effectiveness of the Board of Directors

- ix. Vision of the Board of Directors

- x. Self-evaluation

2. Summary of findings

Outside expert observations based on the aforementioned questionnaire survey are as follows."On the whole, most expressed positive opinions indicating that the effectiveness of the Board of Directors was secured to a considerable extent.

There opinions included responses indicating that free and frank exchange of opinions is conducted and sufficient discussions are made in terms of both the content and time of deliberations, and on top of that, ongoing efforts are being made, including improvements being made in presentations and materials for meetings of the Board of Directors, to make discussions at Board meetings more substantial based on previous evaluations of the effectiveness of the Board of Directors. On the other hand, several directors and Audit & Supervisory Board members pointed out multiple potential areas for improvement in order to further enhance the Board’s effectiveness. These matters are expected to be reviewed in future deliberations of the Board of Directors.”Taking the outside experts’ evaluation seriously, the Board of Directors of the Company discussed the matters pointed out or suggested and decided to reflect the following in managing the Board of Directors going forward.

(1) Board of Directors oriented toward a monitoring model

Regarding matters to be submitted to the Board of Directors, there were some favorable opinions saying that the delegation of authority to the Management Committee and the decision-making bodies of each operating company was proceeding appropriately, and that matters to be submitted to the Board of Directors were similar to those of companies that have adopted the so-called monitoring model. Conversely, there were also many opinions saying that the delegation of authority should be further promoted from the perspective of promoting the transition to the monitoring model, and that the decision-making authority of operating companies should be expanded from the viewpoint of speedy decision-making.

Future approach1) Review of current matters submitted for discussion at Board of Directors meetings

On April 1, 2023, the Company revised the standards for submitting matters to the Board of Directors orienting the standards toward a monitoring model, which has had some positive effects. However, based on the results of this evaluation, in order to further review matters to be submitted to the Board of Directors to secure time for discussion on long-term strategies, the Company decided to consider in detail which matters should be delegated to the Management Committee and the decision-making bodies of each operating company.

2) Review of institutional design

Reaffirming that the institutional design is the foundation of the corporate governance system, the Company decided to deepen its consideration of an appropriate institutional design, taking into account management strategies, changes in the business environment, the requirements of the Corporate Governance Code, and the movements of government study groups, while relating it to the succession plan being promoted by the Nominating Advisory Committee.

In proceeding with the delegation of authority described in 1) above, the Company has also decided to consider whether it is necessary to shift to a company with an Audit & Supervisory Committee or a company with a Nominating Committee, which would enable the Board of Directors to substantially delegate its authority to the executive side, except for certain matters stipulated in the Companies Act.

(2) System and operation to ensure appropriateness of business execution

Many respondents also stated the lack of sufficient human resources and organizational structures required to address the challenge of expanding the overseas business in addition to preventing the recurrence of incidents of misconduct at overseas subsidiaries, which accounted for the majority of opinions.

Future approach

In order to ensure effective group governance, the Company has decided to implement the following recurrence prevention measures resolved at the Board of Directors meeting of the Company on April 15, 2025, and to monitor these measures on a regular basis.

i. Clarification of criteria for appointment of executives of overseas subsidiaries

ii. Strengthening of governance and internal controls at local subsidiaries

iii. Thorough management involvement of the core company and holding company

iv. Reinforcement of auditing and monitoring systems

v. Thorough operation and management of the in-house reporting system

vi. Thorough education and guidance on compliance

- Diagram of Corporate Governance Structure

-

As of June 25, 2024

- Corporate Governance Report

-

Latest Corporate Governance Report

- Risk Management

-

The Nichirei Group has set up the Group Risk Management Committee, chaired by the Representative Director, President, to manage the various risks associated with its business activities, in the most appropriate and rational ways from a comprehensive standpoint, and to maximize the Group’s enterprise value. The committee identifies and evaluates Group-wide risks and Nichirei and its business companies respond to these risks on their own accord, based on the established risk management cycle. Important items are reported to the Board of Directors of Nichirei Corporation, the holding company, which considers the response. Further, Nichirei has introduced an internal reporting system (a hotline) in an effort to minimize risk.