Medium-term Business Plan

“Compass Rose 2024”

Basic Strategy

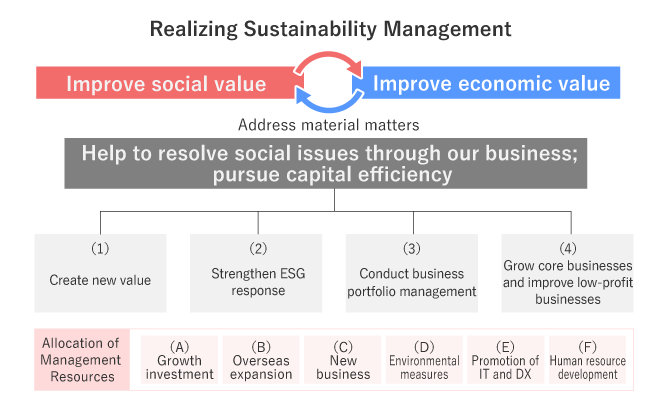

Through business activities based on the Nichirei Group Sustainability Policy: The Nichirei Pledge (see illustration below), the Nichirei Group aims to improve economic and social value by conducting management that pursues capital efficiency while fulfilling its social responsibilities as a company that supports good eating habits and health.

Group Strategies

Help to resolve social issues through our business; pursue capital efficiency

| (1)Create new value |

|

|---|---|

| (2)Strengthen ESG response |

|

| (3)Conduct business portfolio management |

|

| (4)Grow core businesses and improve low-profit businesses |

|

Allocation of Management Resources

| (A)Growth investment |

|

|---|---|

| (B)Overseas expansion |

|

| (C)New business |

|

| (D)Environmental measures |

|

|---|---|

| (E)Promotion of IT and DX |

|

| (F)Human resource development |

|

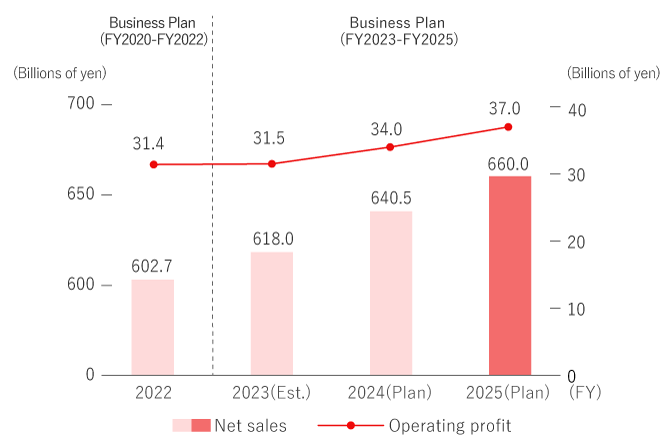

Financial/Non-Financial Targets

| Financial Targets | FY2025 plan | vs. FY2022 | CAGR |

|---|---|---|---|

| Net sales | 660 | +57.3 | 3.1% |

| (Overseas sales) | 130.0 | +32.4 | 10.0% |

| Operating profit | 37.0 | +5.6 | 5.6% |

| (Operating margin) | 5.6% | +0.4 pts. | ― |

| Ordinary profit | 37.8 | +6.1 | 6.1% |

| Profit attributable to owners of parent | 24.5 | +1.1 | 1.6% |

| Profit per share | ¥190 or more | ― | ― |

| EBITDA | 65.0 | +12.5 | 7.4% |

| (EBITDA margin) | 9.8% | +1.1 pts. | ― |

| ROIC | 7% or higher | ― | ― |

| ROE | 10% or higher | ― | ― |

| Non-Financial Targets | |

|---|---|

| Creating new value |

|

| Sustainable procurement |

|

| Climate change countermeasures |

|

| Securing and developing a diverse array of human resources |

|

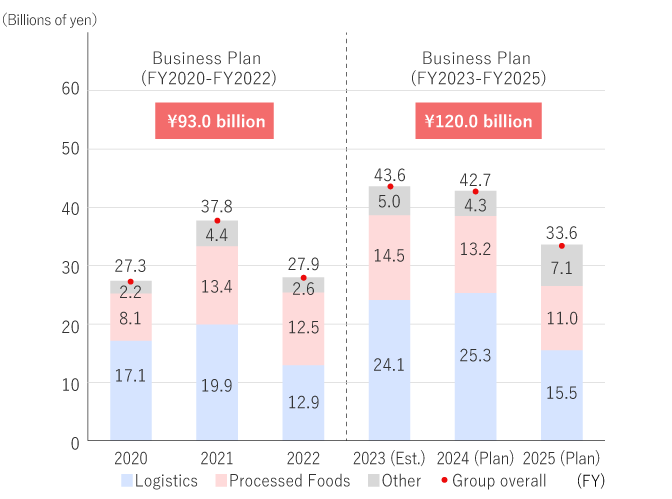

Overview of Capital Expenditures

- Strengthen competitive advantages by continuing concentrated investment in processed foods and temperature-controlled logistics to increase production capacity and number of storage facilities.

- Increase investment in environmental measures to help achieve a sustainable society.

Capital Expenditures in Each Business Plan

Capital Expenditures

| Main Details | |

|---|---|

| Processed foods: ¥38.7 billion |

|

| Temperature-controlled logistics: ¥64.9 billion |

|

| Group total: ¥120.0 billion | |

| Details of Investment in Environmental Measures |

|---|

| Investment in environmental measures: Total ¥29.2 billion (including construction of new refrigerated warehouses)

|

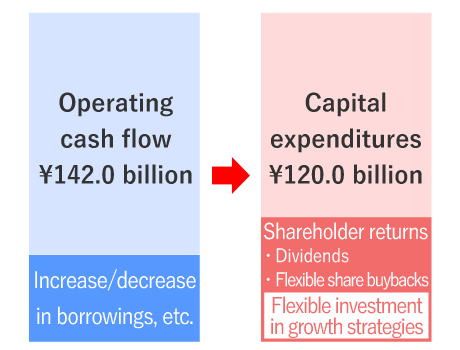

Financial Strategies

- Allocate operating cash flow to investment in core businesses for future growth and returns to shareholders.

- Provide ongoing, steady dividend increases with a target dividend on equity (DOE) of 3%.

- Conduct flexible share buy-backs based on a comprehensive assessment of financial condition and the free cash flow outlook.

- Set a D/E ratio of 0.5 as a yardstick from the viewpoint of financial soundness and capital efficiency.

Allocation of Operating Cash Flow (Plan)

Financial Condition and Cash Flow

(Billions of yen)

| POWER UP 2018 | WeWill 2021 |

Compass Rose 2024 | |

|---|---|---|---|

| Cash flows from investing activities | 102.0 | 119.6 | 142.0 |

| Cash flows from financing activities | -49.6 | -82.5 | -109.0 |

| Free cash flow | 52.4 | 37.0 | 33.0 |

| Dividends paid | 11.7 | 17.7 | 21.0 |

| Share buybacks | 23.0 | 10.0 | ― |

| Total return ratio | 60% | 43% | ― |

| D/E ratio (including leased debt) | 0.5 times | 0.5 times | ― |

Strategies by Business

- Processed Foods Business

Achieve sustainable growth by restoring profitability and establishing new profit drivers. - Marine Products Business

Concentrate management resources on competitive products to improve capital efficiency and profitability. - Meat and Poultry Products Business

Expand sales of differentiated products using “kodawari” ingredients*. - Temperature-controlled Logistics Business

Help to resolve social issues and strengthen the business foundation for the next generation to improve future capital efficiency.

(Billions of yen)

| FY2022 results | FY2025 plan | vs. FY2022 | CAGR | ||

|---|---|---|---|---|---|

| Net sales | Processed Foods | 244.2 | 275.0 | +30.8 | 4.0% |

| Marine Products | 67.7 | 44.0 | -23.7 | -13.4% | |

| Meat and Poultry | 80.3 | 95.0 | +14.7 | 5.8% | |

| Logistics | 224.5 | 260.0 | +35.5 | 5.0% | |

| Real Estate | 4.3 | 4.8 | +0.4 | 3.6% | |

| Other | 4.2 | 6.7 | +2.5 | 17.0% | |

| Adjustment | -22.6 | -25.5 | -2.9 | ― | |

| Net sales | 602.7 | 660.0 | +57.3 | 3.1% | |

| Operating profit | Processed Foods | 14.2 | 18.4 | +4.2 | 8.9% |

| Marine Products | 1.0 | 1.0 | +0.0 | 1.5% | |

| Meat and Poultry | 1.2 | 2.0 | +0.8 | 19.6% | |

| Logistics | 14.6 | 16.2 | +1.6 | 3.5% | |

| Real Estate | 1.7 | 2.2 | +0.5 | 10.0% | |

| Other | -0.3 | 0.5 | +0.8 | ― | |

| Adjustment | -0.9 | -3.3 | -2.4 | ― | |

| Operating profit | 31.4 | 37.0 | +5.6 | 5.6% |

Consolidated Net Sales and Operating Profit